[ad_1]

Becoming a member of the festive bandwagon, the Govt of India has lately introduced a particular scheme for all Central Authorities workers, in addition to sure private-sector workers

Because of the massive multiplier on the spend (3x the LTC), some shoppers could hesitate to initially spend fairly a big quantity simply to avail of a tax exemption on it

The festive demand is prone to surge, the LTC vouchers and wage advance schemes by the Govt taking part in a key position in it

The Authorities of India lately introduced the Depart Journey Concession (LTC) money voucher scheme to extend the buying energy of Indian shoppers throughout the festive season. A optimistic step in the direction of boosting demand and reviving the financial system, central Authorities workers can now submit a number of payments of products and companies bought in their very own title to avail the advantage of the LTC scheme.

Will the scheme end in a much-needed spur in demand? Which items would profit from it? This text explores the nuances of the scheme and its implications on shopper demand.

With the festive season approaching, one can see massive reductions, engaging affords, and a slew of recent merchandise being marketed. Even throughout the Covid-19 pandemic, Indians have rightfully begun to get into the festive temper, planning, if not for holidays this 12 months, then actually for a splurge on new gadgets for the family. Judging this imminent surge in demand, massive ecommerce gamers even have rolled out their standard annual massive financial savings schemes.

Becoming a member of the festive bandwagon, the Authorities of India has lately introduced a particular scheme for all Central Authorities workers, in addition to sure private-sector workers. This scheme entails a one-time money fee as a substitute of depart journey concession (LTC) and leaves encashment, plus a festive particular wage advance mortgage of INR 10,000. To spur demand within the Indian financial system and buying energy of shoppers, the Union Finance Minister corroborates that the scheme has the potential to generate demand price INR 28,000 crore. This scheme is projected to extend the buying energy of Indian shoppers by INR 10,000 straight and in proportion to their LTCs not directly.

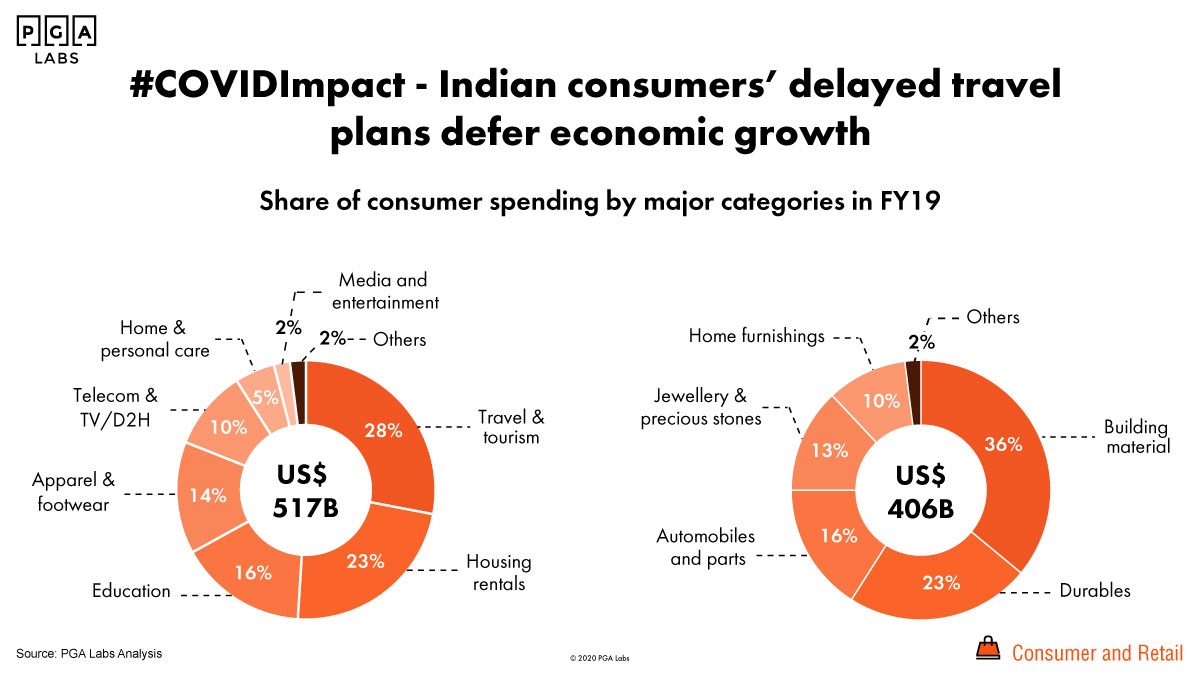

The chart under reveals the spending on varied items and companies by Indian shoppers in FY19. For the reason that journey and tourism business has been harm severely throughout the pandemic, shoppers are prone to deal with different family spending equivalent to attire and footwear, private care, media, shopper durables, vehicles, jewellery, furnishings, and so forth. We will gauge the rise in demand for these merchandise resulting from this scheme.

Nonetheless, the advantages of this scheme will probably be topic to sure circumstances. An worker, choosing this scheme, will probably be required to purchase items or companies thrice the overall LTC for the block of 2018-2021 if not availed earlier than. It is going to be legitimate on items and companies that carry a GST charge of not lower than 12%. Furthermore, the fee must be digitally obtained by the GST registered distributors or service suppliers and create a voucher indicating the GST quantity and the quantity of GST paid.

What this implies for the common wage earner is that they will spend cash to purchase that long-awaited new washer or get that much-desired inside design completed. And the bills could be exempted from revenue tax too. Shoppers who’ve plans in place to purchase a brand new gadget, or get an costly service, however couldn’t accomplish that as a result of pandemic and the following uncertainty, would discover the scheme very helpful.

Because of the massive multiplier on the spend (3x the LTC), some shoppers could hesitate to initially spend fairly a big quantity simply to avail of a tax exemption on it. Thus, those that already ready to purchase luxurious items and companies would profit probably the most from the scheme, however the proportion of workers utilizing this scheme might be decrease than anticipated. But, on the brighter aspect, the profitable tax exemption choice might additionally incentivize shoppers, who in any other case wouldn’t have made a big capital expenditure, to take action now. The chance that, if not availed, one would lose all the corpus, might end in larger spending.

The particular pageant advance scheme to avail of INR 10,000 interest-free mortgage that the staff would wish to pay again in 10 instalments might be very useful for many who are at the moment going through a money crunch however need to purchase sure items or avail of sure companies.

Getting cash in hand right now and having to repay it later, is mostly thought of higher than getting it tomorrow altogether, and most workers would profit from the early money in hand for festive purchases. Since it’s seemingly that some non-public workers could have misplaced jobs or confronted pay-cuts, this wage advance might additionally assist in bringing stability to the demand from the Authorities workers’ aspect.

In a nutshell, the festive demand is prone to surge, the LTC vouchers and wage advance schemes by the Authorities taking part in a key position in it. The magnitude of the impression on demand might be larger for high-value shopper items classes equivalent to shopper electronics, dwelling furnishings, and vehicles.

The article was co-authored by Madhur Singhal, MD and Follow Chief – Client and Retail, Praxis World Alliance and Abhishek Maiti, Head – PGA Pulse, Aggressive Intelligence and Monitoring Enterprise Unit of Praxis World Alliance.

[ad_2]